does kansas have estate tax

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

New Year S Day Antique Coleman Lantern Auction

Review your estate plan periodically with your attorney to.

. Property Tax Savings in the Sunflower State With a Kansas Safe Senior Property Tax Refund. New Jersey phased out its estate tax in 2018. Your average tax rate is 1198 and your marginal tax rate is 22.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. In this detailed guide of the inheritance laws in the Sunflower State we break down intestate succession probate taxes what makes a will valid and moreIf you want professional guidance for your estate plan SmartAssets free financial. The federal estate tax applies to all estates in the United States of America that have a valued of slightly over eleven million dollars and are owned by a single person.

Median property prices are currently around 160000 and are rising by. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

This is a tax based on. Kansas is not a friendly place when it comes to property tax rates for its residents. National average of 107.

The new process is based on the number of pages in the mortgage or deed filing and paid by buyers. Kansas is not one of the states with low property tax though and any future. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma.

Kansas has a 650 percent state sales tax rate a max local sales tax rate of 400 percent and an average combined state and local sales tax rate of 870 percent. States counties and municipal authorities may impose transfer taxes on real estate sales. The states average effective property tax rate annual property taxes paid as a percentage of home value is 137.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Kansass tax system ranks 24th overall on our 2022 State Business Tax Climate Index. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

With a property tax rate of 137compared to a national average of 107you stand to be hit with a hefty property tax bill every year. The state sales tax rate is 65. While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly high.

Updated December 21st 2021. As of 2013 estates in Kansas are not subject to a state-level estate tax. This tax is called an ad valorem tax.

Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. The District of Columbia moved in the. How Much Are Real Estate Transfer Taxes in Kansas and Who Pays Them.

However rates can differ depending on where you live. Kansas began to phase out its estate tax in 2008 and completely eliminated the tax in 2010. Kansas has a 400 percent to 700 percent corporate income tax rate.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax.

Kansas is tough on homeowners. They impose these taxes on the transfer of legal deeds certificates and titles to a property when a seller makes the sale to the buyer. Fortunately here in Kansas and in Missouri we have no state estate tax and no inheritance tax.

Kansas does not have an estate tax but residents of the Sunflower State may have to pay a federal estate tax if their estate is of sufficient size. Real estate transfer fees used to be complex in Kansas but have recently been reformed to make the process much simpler and easier to figure out. Kansas Income Tax Calculator 2021.

Property is cheap in Kansas with an average house price of 159400 so your annual liability is at least kept to a median of 2235. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Kansas Real Estate Transfer Taxes.

The average property tax rate in Kansas sits at 137 which is considerably higher than the US.

Kansas Estate Tax Everything You Need To Know Smartasset

1980 Sedgwick County Paperweight Wichita Kansas Rare Vintage Etsy In 2022 Sedgwick Wichita Paper Weights

Kansas Sales Tax Rates By City County 2022

Squatter S Rights Kansas 2022 Adverse Possession Laws In Ks

Get A Kansas Real Estate License Online Pricing Packages Real Estate License Real Estate Classes Business Ebook

Want To Know Where Millennials Are Buying Homes And For How Much Stemlending Com Team Tracks The Latest In Mortgage An Home Ownership Home Buying Millennials

Kansas Last Will And Testament Legalzoom

Property Tax Kansas County Treasurers Association

1 Day Only Nice Downsizing Moving Estate Sale Starts On 8 30 2015 Platte Estate Sale City

Six Rural Kansas Towns Offer Free Land To Transplants Here S The Deal

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

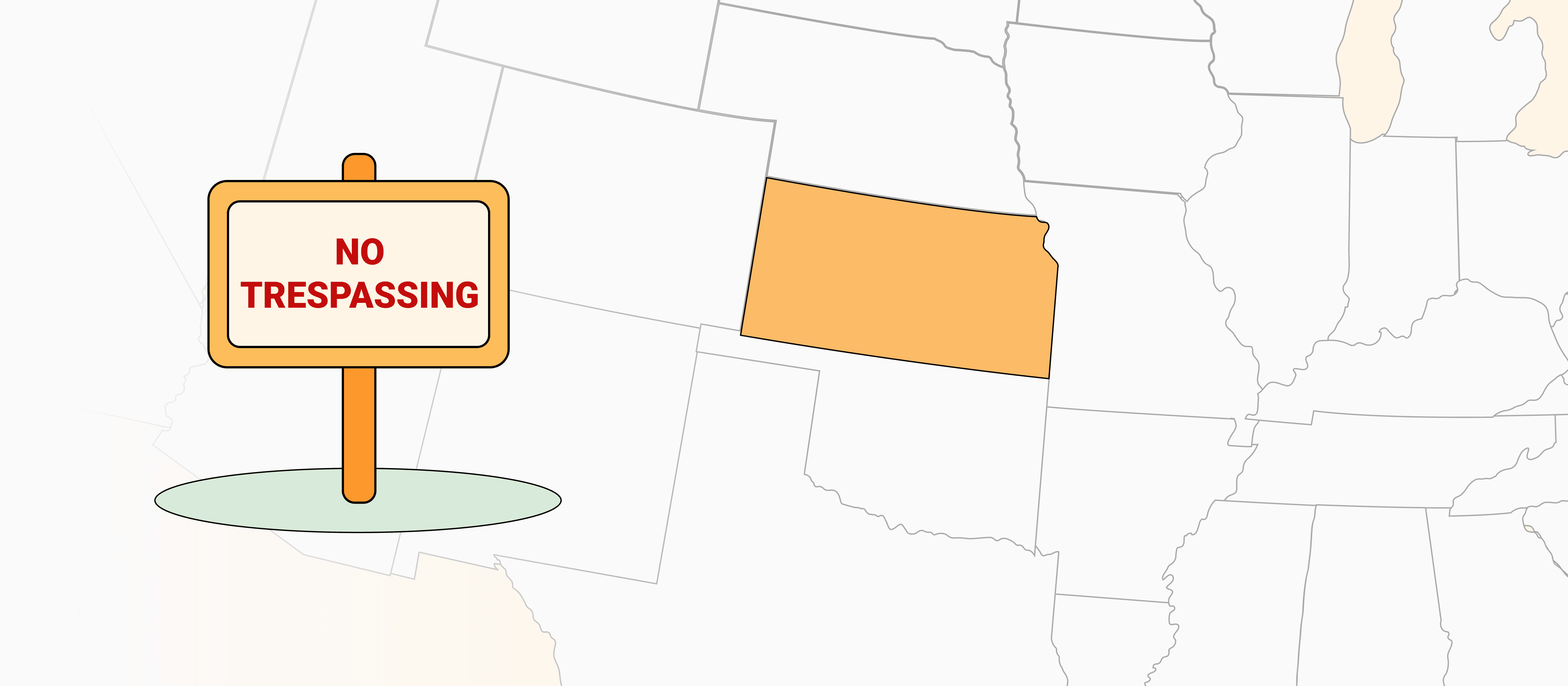

Delinquent Real Estate Unified Government Of Wyandotte County And Kansas City

Kansas Estate Tax Everything You Need To Know Smartasset

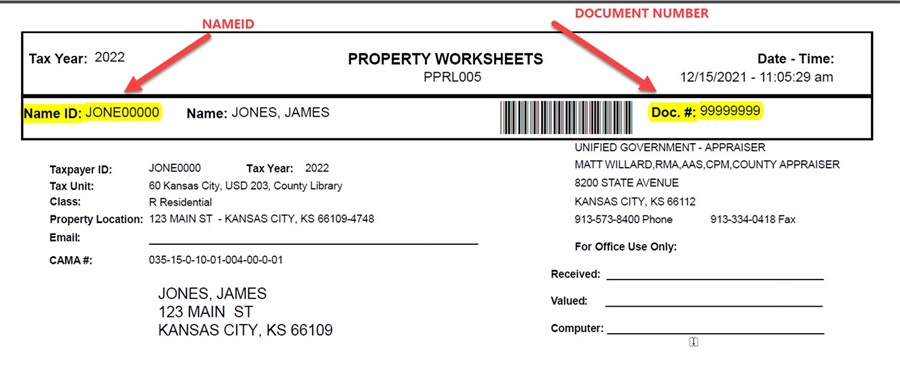

Personal Property Unified Government Of Wyandotte County And Kansas City

Glamping In Missouri Hawley Farm Glamping United States In 2022 Glamping Safari Tent Hawley

Kansas Estate Tax Everything You Need To Know Smartasset

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

The Ultimate Guide To Kansas Real Estate Taxes

Frequently Asked Questions About Probate Kansas Legal Services